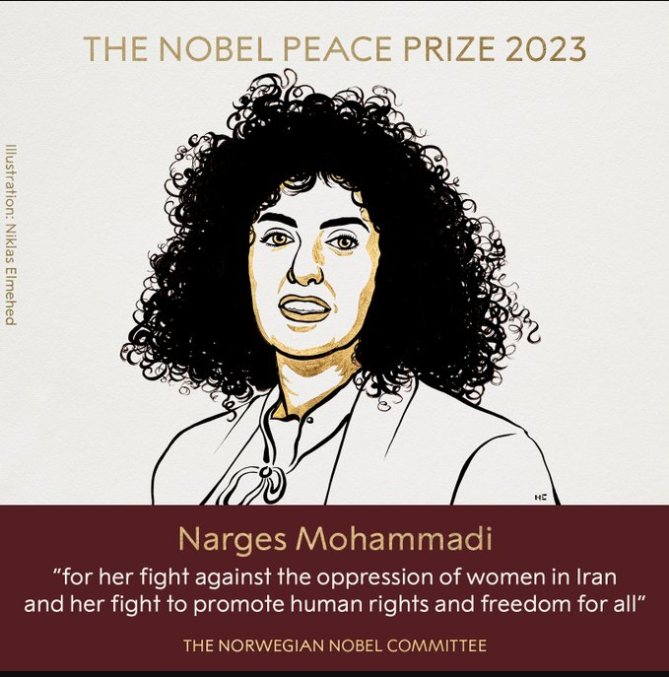

Nobel Peace Prize 2023 dawng tur Narges Mohammadi

Khawvela chawimawina ngaihhlut, Nobel Peace Prize 2023 dawng turin jail-a tang mek, Iranian human rights activist Narges Mohammadi chu thlan a ni.

Kum 51 mi, Narges Mohammadi hi hmeichhiate hnuaichhiah leh rahbehna do let a,Iran rama mihring dikna chanvo leh zalenna tun din a nih theihna atana beitu a ni. Hmeichhe zinga Nobel Peace Prize dawng thei tur 19-na a ni. He chawimawina hi December 10-ah Oslo-a hlan a ni dawn a, chawimawina hian pawisa fai, Swedish crown maktaduai 11 (USD mtd 1) a keng tel.

Mohammadi hi hmeichhiate dinhmun chhiatna, Iran-a hmeichhiate dikna chanvo hum tura beitu, human rights activist zinga mi niin, Shirin Ebadi kaihhruai non-governmental organisation, Defenders of Human Rights Center-ah deputy head a ni mek bawk. Ṭum 13 man a tawk tawh a, ṭum nga thiam loh chantirin hremna atan vawi 154 vuak a tawrh tawh bakah, kum 31 tang tura hrem a ni bawk. Tunah hian Tehran tan inah a tang mek a ni.

Norwegian Nobel Committee chuan Mohammadi chu human rights advocate leh freedom fighter a ni tiin, huaisen taka Iran rama mihring dikna chanvo, zalenna leh democracy tun din a nih theihna atan a beihna chu chawimawi tlak a ni, a ti. Mohammadi hian kumin kum tir lam khan United Nations World Press Freezom Prize a lo dawng tawh bawk.

Royal Swedish Academy chuan Nobel Prize 2023 dawng turte hi Thawhlehni aṭang khan a puang chhuak ṭan a ni. Nobel Prize in Physiology or Medicine dawng turin Hungarian-American Katalin Kariko leh American Drew Weissman thlan an ni a, Physics Prize dawng turin French scientist Pierre Agostini, Hungarian Ferenc Krausz leh French-Swedish physicist Anne L'Huillier-te thlan an ni.

Nobel Prize in Chemistry, 2023 dawng turin quatum dots nihna leh insiam dan hmu chhuaktu, US scientist pathum Moungi G.Bawendi, Louis E.Brus leh Alexei I. Ekimov-te thlan an ni a, Nobel Prize in Literature 2023 dawng turin Norwegian author, Jon Fosse chu thlan a ni bawk. Economic Sciences Prize dawng tur hi October 9-ah puan a ni ang.